Aam Aadmi Bima Yojana 2021 Claim Procedure | AABY Scheme deposit 100 rupees a year and get insurance of 75000 rupees | insurance scheme for unorganized sector workers | आम आदमी बीमा योजना

Most workers are still without any social security coverage. Recognizing the need to provide social security to these workers, the Central Government has introduced a Bill in Parliament.

A major insecurity for workers in the unorganized sector is that there are frequent incidences of illness for medical care and hospitalization of such workers and their family members. Despite the expansion in healthcare facilities , the disease remains one of the most prevalent causes of human deprivation in India.

It has been clearly recognized that health insurance is a way to provide protection to poor families from the risk of health spending in poverty. However, most efforts to provide health insurance in the past have encountered difficulties in both design and implementation. The poor are unable or unwilling to seek health insurance due to their cost, or lack of perceived benefits.

Table of Contents

Aam Aadmi Bima Scheme 2021

The AABY Scheme focuses on changing the topography of the Indian economy. The scheme was first announced by the Central Government in 2007 but the scheme was fully implemented in January 2013 across the country. The primary objective of this scheme is to provide social security and financial assistance to the people of rural India.

The scheme includes not only those who are classified as below the poverty line, as those places with no other access to urban hospitals, such as large hospitals or good pharmacies. In addition, the scheme has been extended to those who have been held back due to lack of proper assistance, including among the nurtured middle-class citizens of India.

Aam Aadmi Bima Yojana Online Claim Procedure

If you are thinking of applying online in this Aam Aadmi Bima Yojana, then let us tell you that at present, there is no procedure available to apply online in this scheme. You can avail of the scheme through the process mentioned below. Can

The scheme is based on the nodal agency model. A nodal agency may be a panchayat, NGO, self-help group or any other institutional arrangement. So if you want to become a partner of this scheme then you can get advice from the nearest nodal agency or you can contact your nearest LIC branch office

The benefit of death or disability claims under the scheme will be credited directly to the bank accounts of the former beneficiaries with direct competence in such cases by paying directly to the beneficiaries through NEFT by LIC’s P & GS unit or where NEFT facility is not available. In the event of the member’s death during the period of coverage and after the policy comes into force, his / her nominee will have to make an application along with the Death Certificate for payment of the claim amount to the designated officer of the nodal agency.

Aam Aadmi Bima Yojana 2021 Apply Online

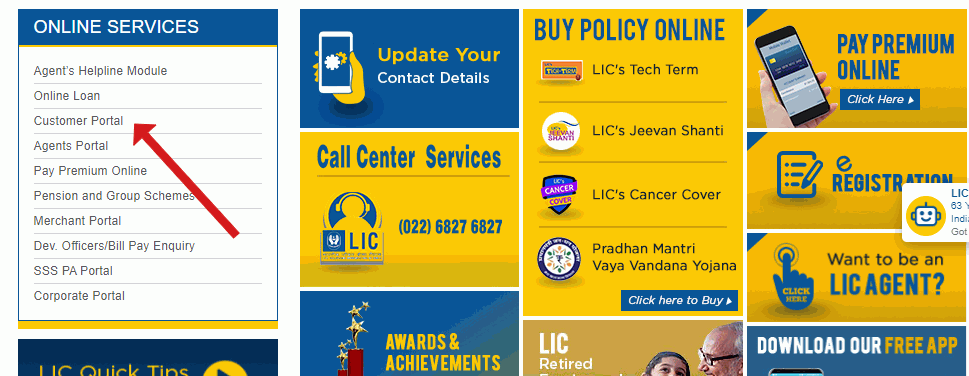

If a person wants to apply for this scheme online, then he can do it only from the official website of Life Insurance Corporation of India. To apply LIC Aam Aadmi Bima Yojana online, follow all the steps given below:

- To apply, first go to the website https://licindia.in/

- Now click on the “Customer Portal” link under the ONLINE SERVICES section of the website

- Click on the Apply Now link under the LIC Online Service Portal section available in the right sidebar of the website.

- Now the form of Apply Now will open in front of you, in which fill all the information requested such as your name, mobile number, email ID, date of birth, address etc.

- After filling the form, put a check mark in the box of term and condition and click on submit button

Aam aadmi bima yojana form PDF Download

All the people who are looking for the application form of the scheme can download the form of this scheme through the link given below:

Aam Aadmi Bima Scheme Claim Procedure

The benefit of death or disability claims under the scheme will be credited directly to the bank accounts of the former beneficiaries with direct competence in such cases by paying directly to the beneficiaries through NEFT by LIC’s P & GS unit or where NEFT facility is not available . Authorization can be paid by A / C payee check or any other mode decided by the claim LIC.

In the event of the member’s death during the period of coverage and after the policy comes into force, his / her nominee will have to make an application along with the Death Certificate for payment of the claim amount to the designated officer of the nodal agency.

AABY Death Claim Procedure

- The application will be submitted to the nodal agency officer along with the death certificate.

- The designated officials of the concerned nodal agency will verify the claim letters.

- The officer will submit the papers, including the application, death certificate, whether the beneficiary is marginalized above the BPL or BPL family and a statement on whether they are associated with the business group.

- Finally, the nodal agency will duly verify a copy with the original certificate.

AABY Accident Claim Procedure

Along with the death registration certificate, the following documents have to be submitted to the nodal agency.

- FIR copy

- Postmortem report

- Police inquiry report

- Police Findings Report / Police Final Report

Aam Aadmi Bima Scheme Scholarship Claim Procedure

The member whose child is eligible for the scholarship will fill the half-yearly application form and submit it to the nodal agency. The nodal agency will identify the students.

In return, the nodal agency will submit the list of beneficiary students to the concerned P&GS unit with complete information such as student name, school name, class, member name, master policy number, membership number, and NEFT details for direct payment. .

Every half-year, for July 1 and January 1, each year LIC will credit the scholarship payment by NEFT to the beneficiary student’s account.

Aam Aadmi Insurance Scheme Premium

Initially the premium charged under the scheme will be Rs 200 / – per member for a cover of Rs 30,000 / – per year, out of which 50% will be subsidized from Social Security Fund.

The remaining 50% of the premium for Rural Landless Household (RLH) will be borne by the State Government / Union Territory and in the case of other business groups, the remaining 50% of the premium will be borne by the Nodal Agency and/or Member and/or State. Government / Union Territory

Benefits Of Aam Aadmi Bima Yojana

- An amount of Rs 30,000 will be provided to the nominee or family member of the policy holder if the person dies naturally.

- If the person has died due to an accident or is permanently incapacitated in the accident, the nominee or a policyholder’s family member will be given Rs 75,000.

- If the person is found in an accident with permanent partial disability, resulting in loss of eye or limb or any other accident; Rs 37,500 will be given to a nominee or a member of the policyholder’s family.

Eligibility Criteria Of Aam Aadmi Bima Scheme

- Members must be between 18 years of age and approximately 59 years of birthday.

- The member should normally be the head of the family or a earning member of a Below Poverty Line family (BPL) or slightly above the poverty line under the identified occupational group / rural landless family.

- The applicant can be one of the earning members of the family which is classified under Below Poverty Line (BPL).

- Applicant may be above poverty line but should be identified under occupational group / rural landless family.

Scheme Nodal Agency

“Nodal Agency” shall mean the Central Ministry Department / State Government / Union Territory of India / any other institutional arrangement / appointed by any registered non-government organization to conduct the scheme as per rules. In the case of “rural landless families”, the nodal agency shall mean the State Government / Union Territory appointed to operate the scheme.